FOREX

4. Foundations/Indicators

MACD:

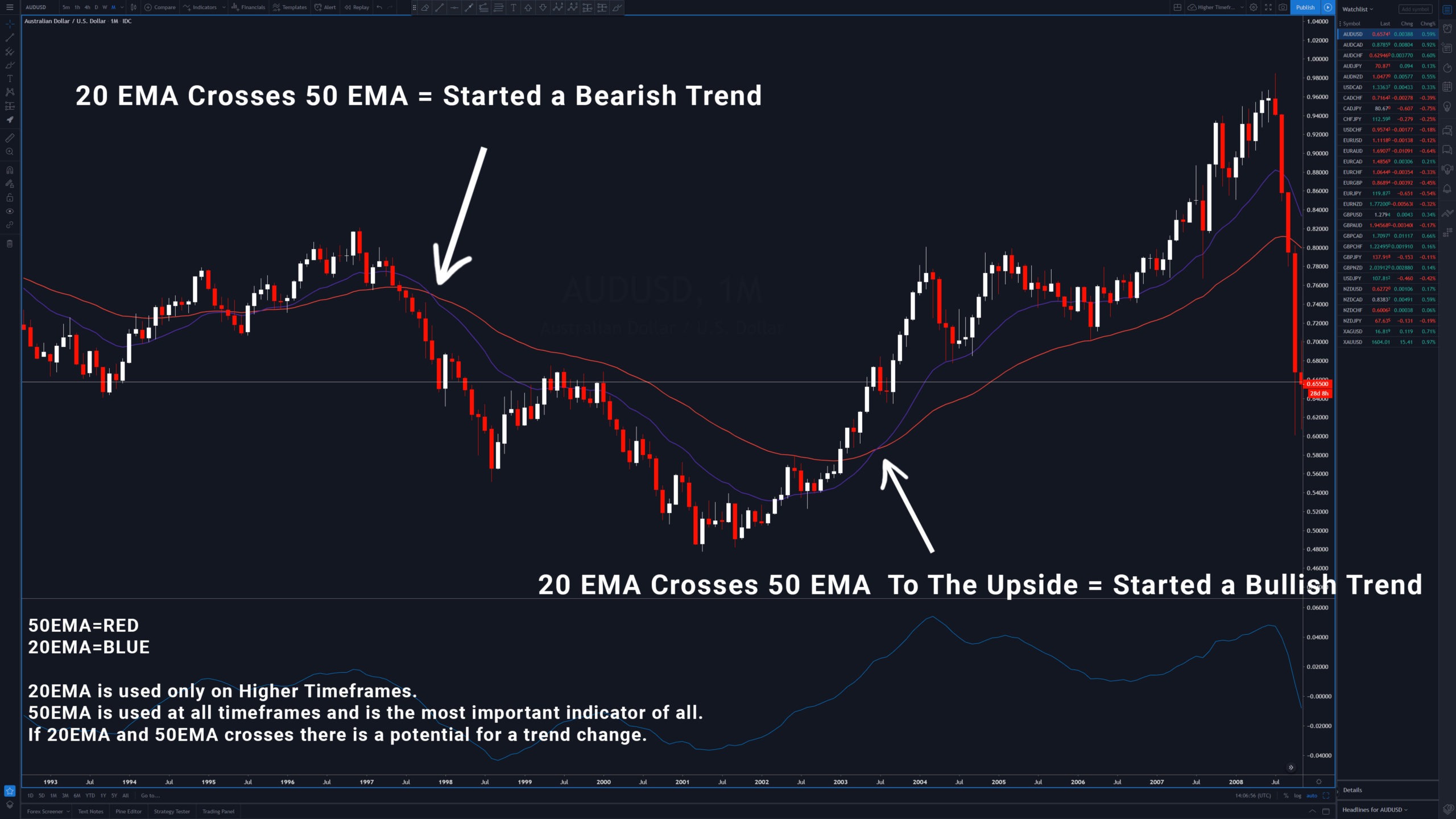

20EMA & 50EMA

Support & Resistance

VOLUME This indicator tells us that there is a lot of action or volatility in the market. We will utilize this indicator on the 5-minute timeframe only, for timing our entries. When volume spikes this means people are buying or selling and we want to mainly trade around periods of high volume which, will allow for momentum. In this lesson, Irek explains when the high volume trading sessions take place for the foreign exchange market (London, NY and Asian Session). Regarding the equities market, generally, you’ll see volume spiking within the first hour or so after market open, and potentially again during the last hour for an end of day run.

Candles

Reversal Candlestick Formations

All Candlestick Formations Should Be Rejecting Something. They must always happen at support/resistence.

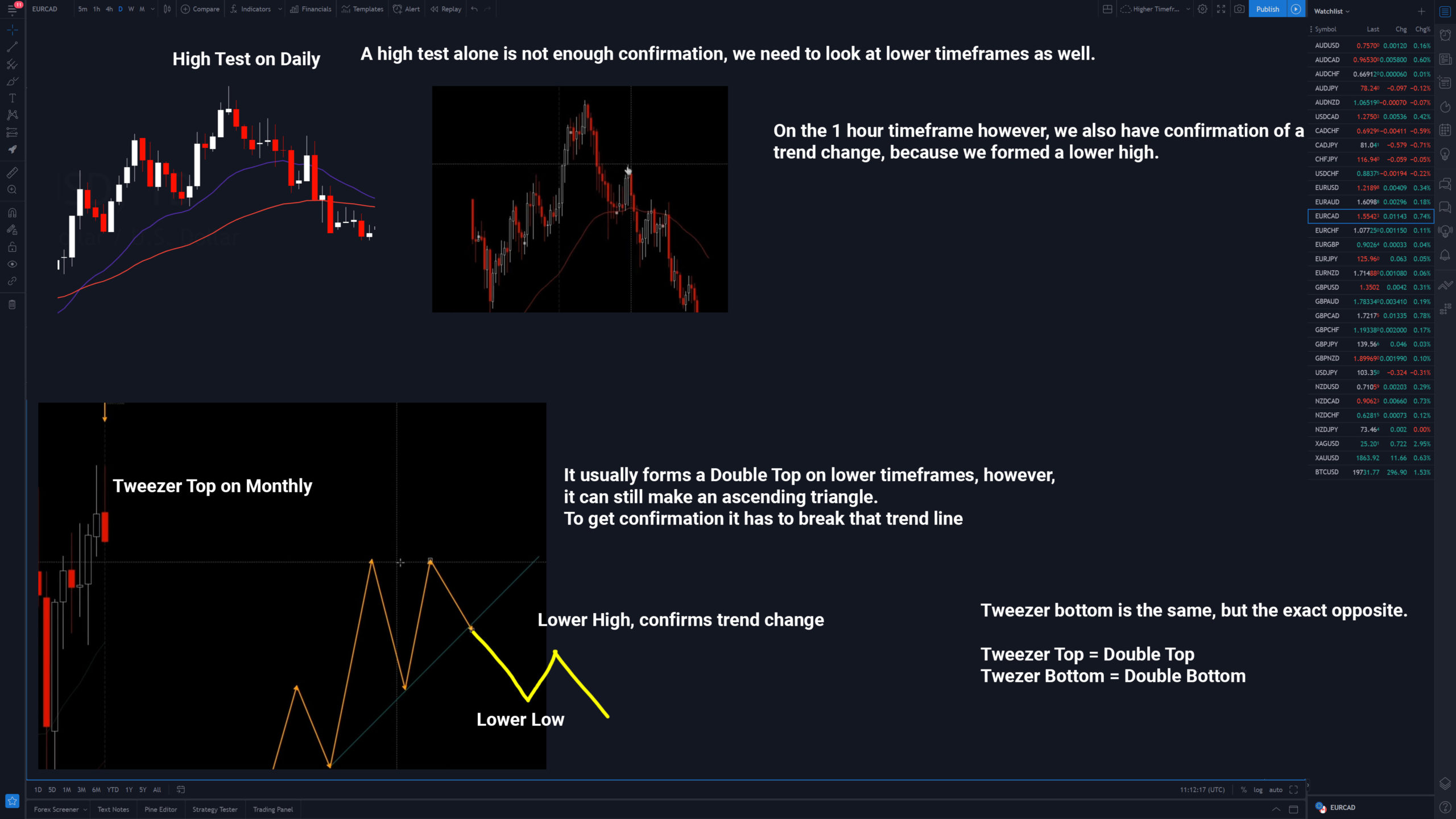

High-test / low-test – Tweezer top / tweezer bottom

Bullish high test = white

Bearish high test = red

Bullish low test = white

Bearish low test = red

on the picture below, we have a bullish high test, and a bearish low test.

Bearish / bullish engulfing

It must be rejecting something, for it to be a valid.

The following ones are not as strong as the previous ones.

These are strong when there is a combination of candlestick formation patterns.

For example: Combined with a high-test reversal.

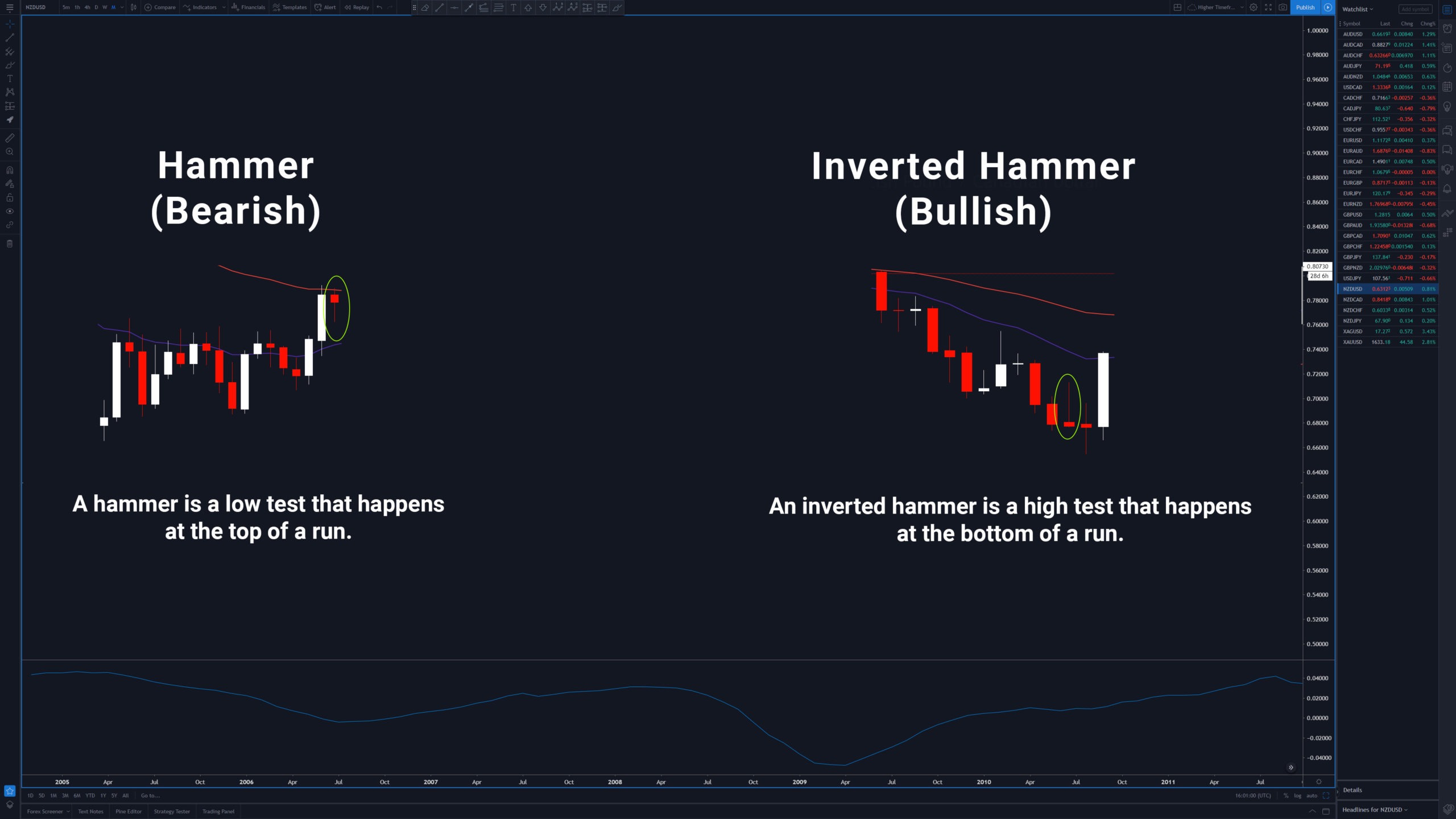

Hammer / inverted hammer

It's pretty much a low-test/high-test, but at a different place.

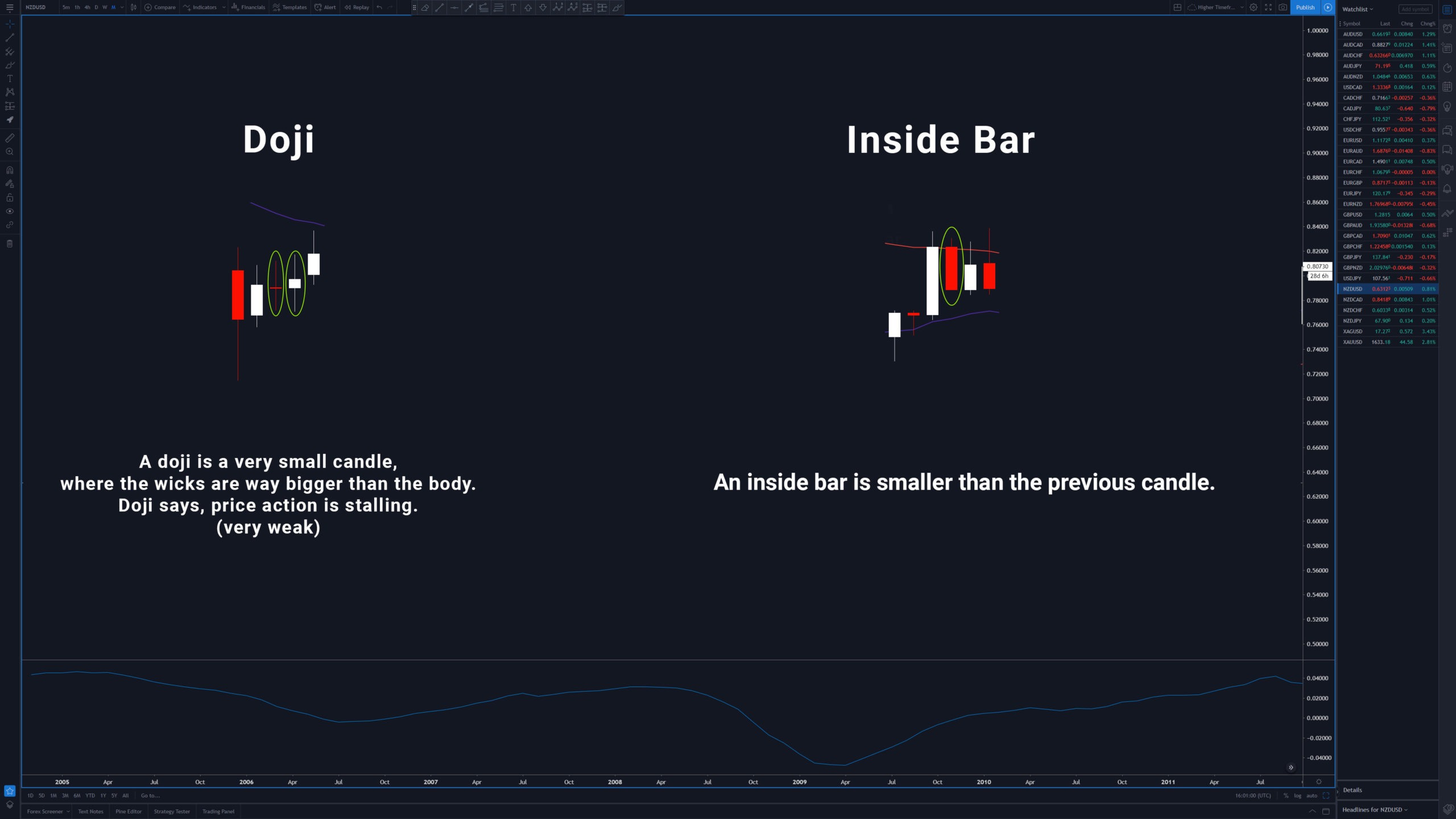

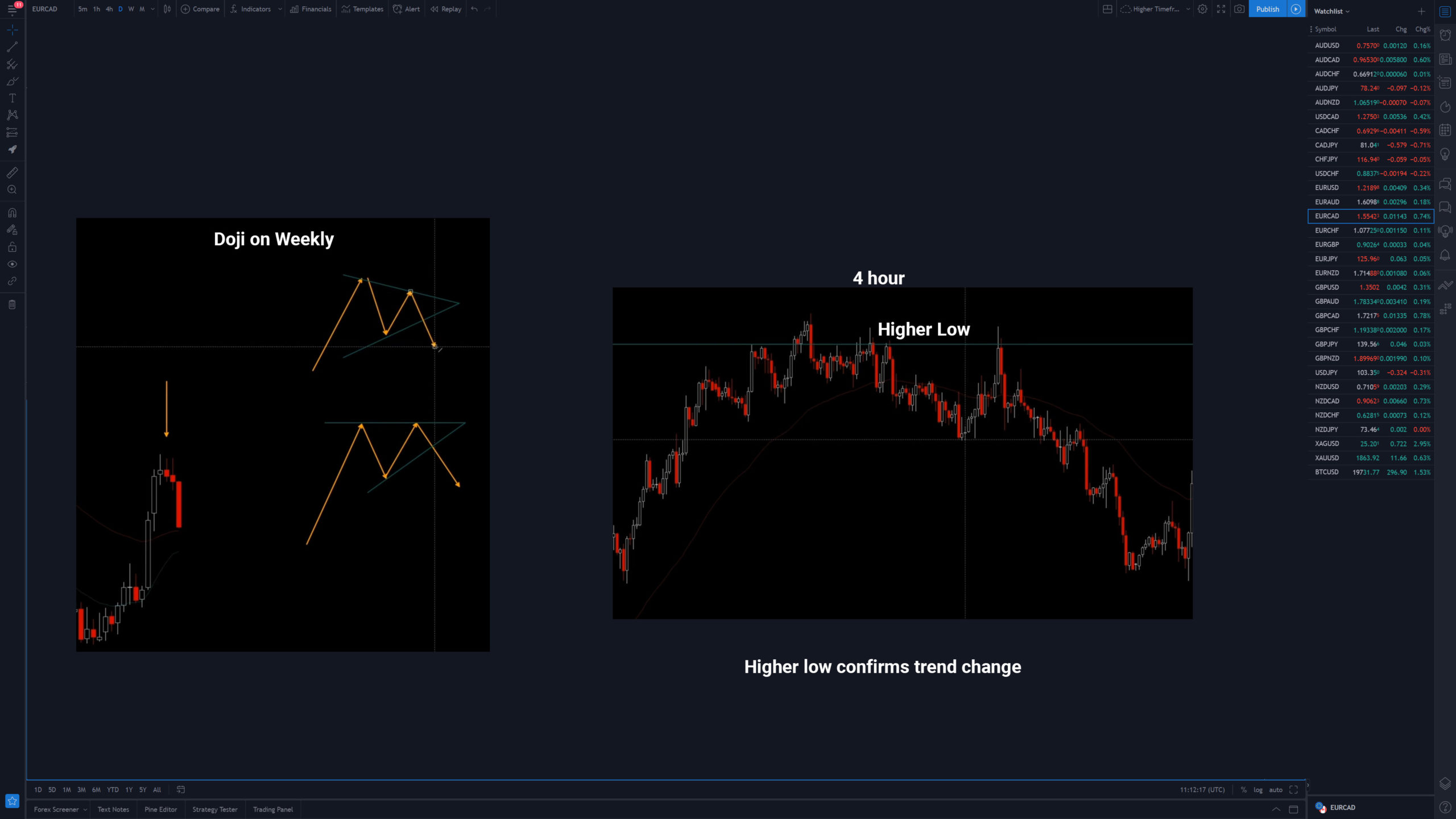

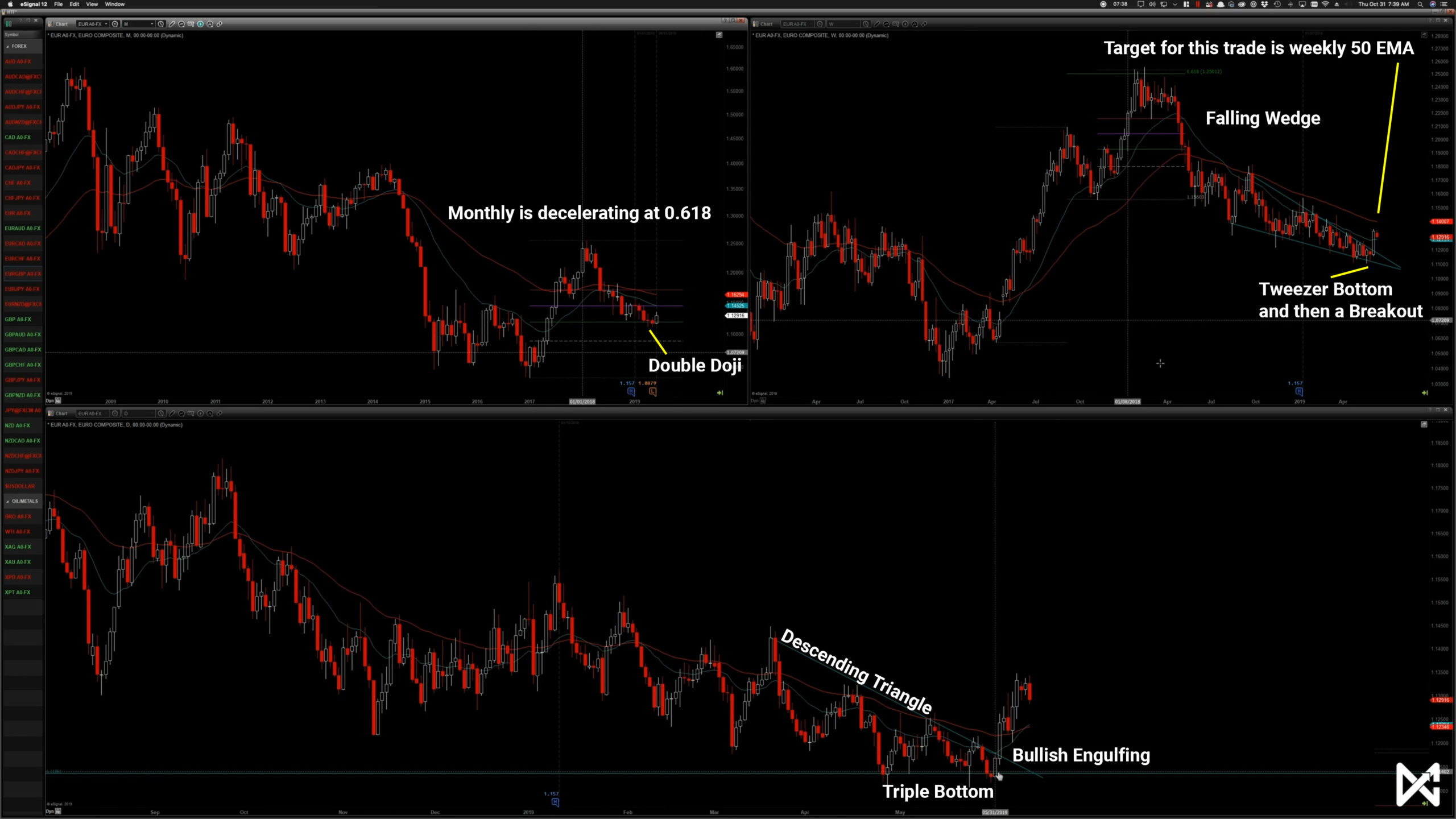

Doji and Inside Bar

Deceleration & Consolidation

It’s very important to understand what deceleration is, and also what consolidation looks like. 9 times out of 10 we need some sort of deceleration to be present in the market before executing a trade… deceleration is a signal that price may be turning around (i.e. price was accelerating to the upside, but reached a support and resistance level such as a horizontal line, and then began to slow down, ‘decelerate’, and potentially reject that level).

On the other hand, when we are witnessing periods of consolidation in the market, we want to avoid executing trades. Consolidation is messy, sideways price action, signalling indecision. We don’t want to trade during periods of consolidation, instead, we want to wait for a clear breakout above or below the sideways price action.

Deceleration has to hit a resistance/support level and will usually have a reversal candlestick formation at the end.

Deceleration starts out with a big candle and then gets smaller and smaller as we approach a resistance/support level.

Deceleration might turn into consolidation. Consolidation looks messy, while deceleration looks clean and simple.

Deceleration can last anywhere from a day to 5 days on a daily. On other timeframes it is around 2-5 candles usually.

If it runs longer, it is probably a consolidation.

Consolidation is indecision in the market.

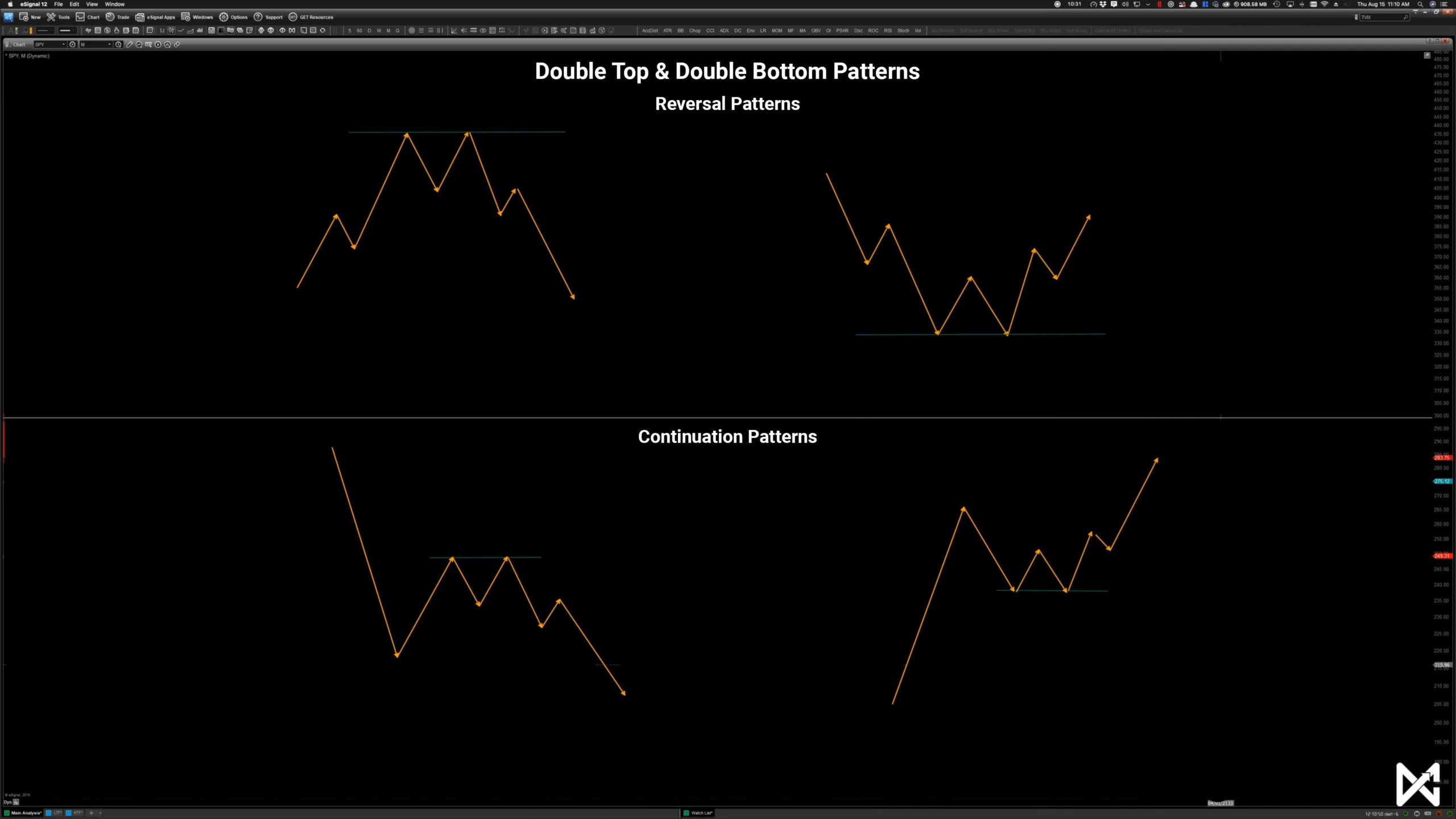

Market Conditions

Fibonacci Retracement

The Fibonacci Retracement tool measures the potential pullback within a run.

It is something that you will utilize in your analysis every day. It’s used for planning entries, stops and even targets.

Fibonacci Extension

ezt újranézni és javítani. nincs 0 vszeg

The Fibonacci Extension tool is utilized to measure the actual run within a trending market (as opposed to the retracement tool, which measures the pullback).

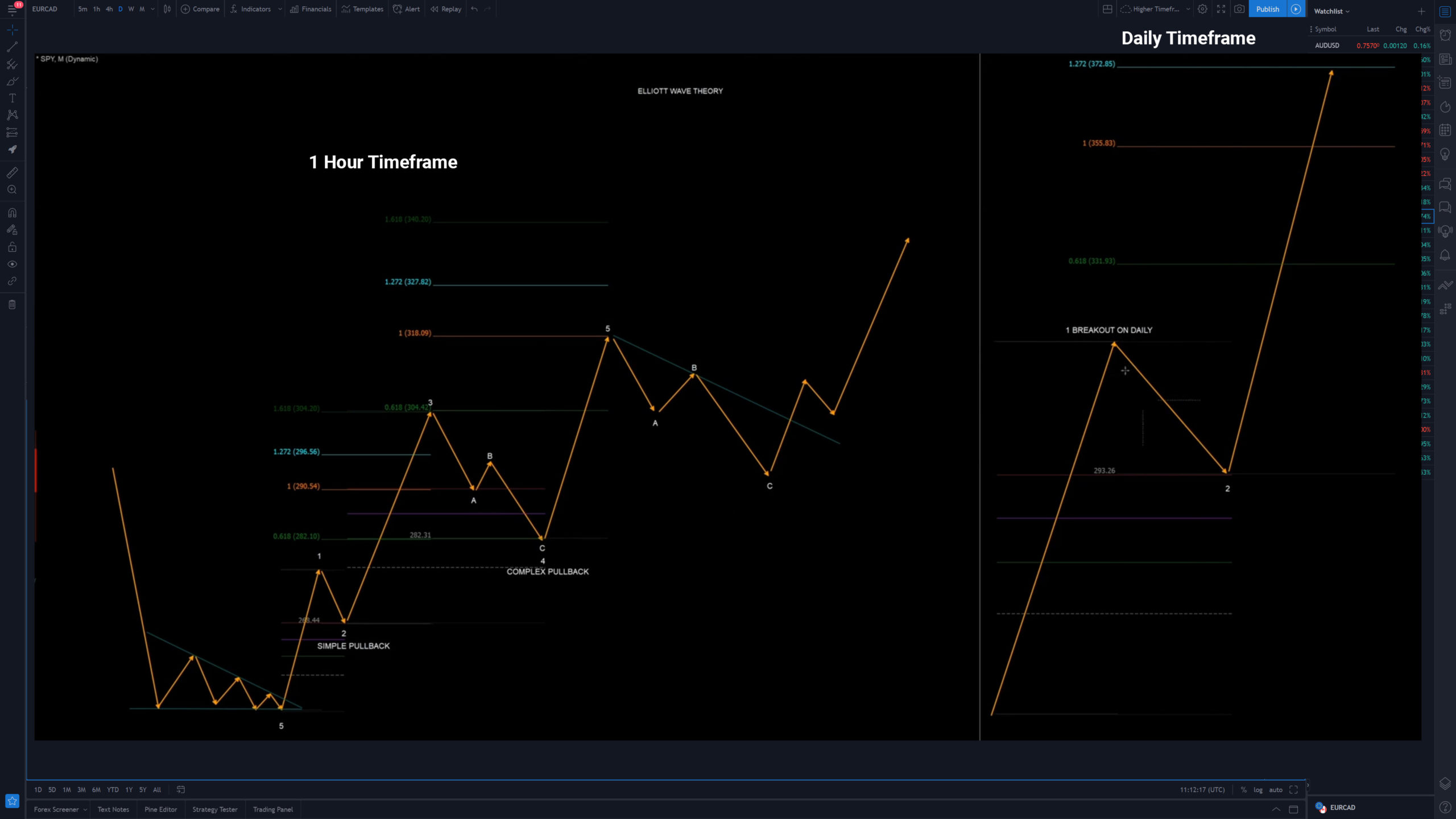

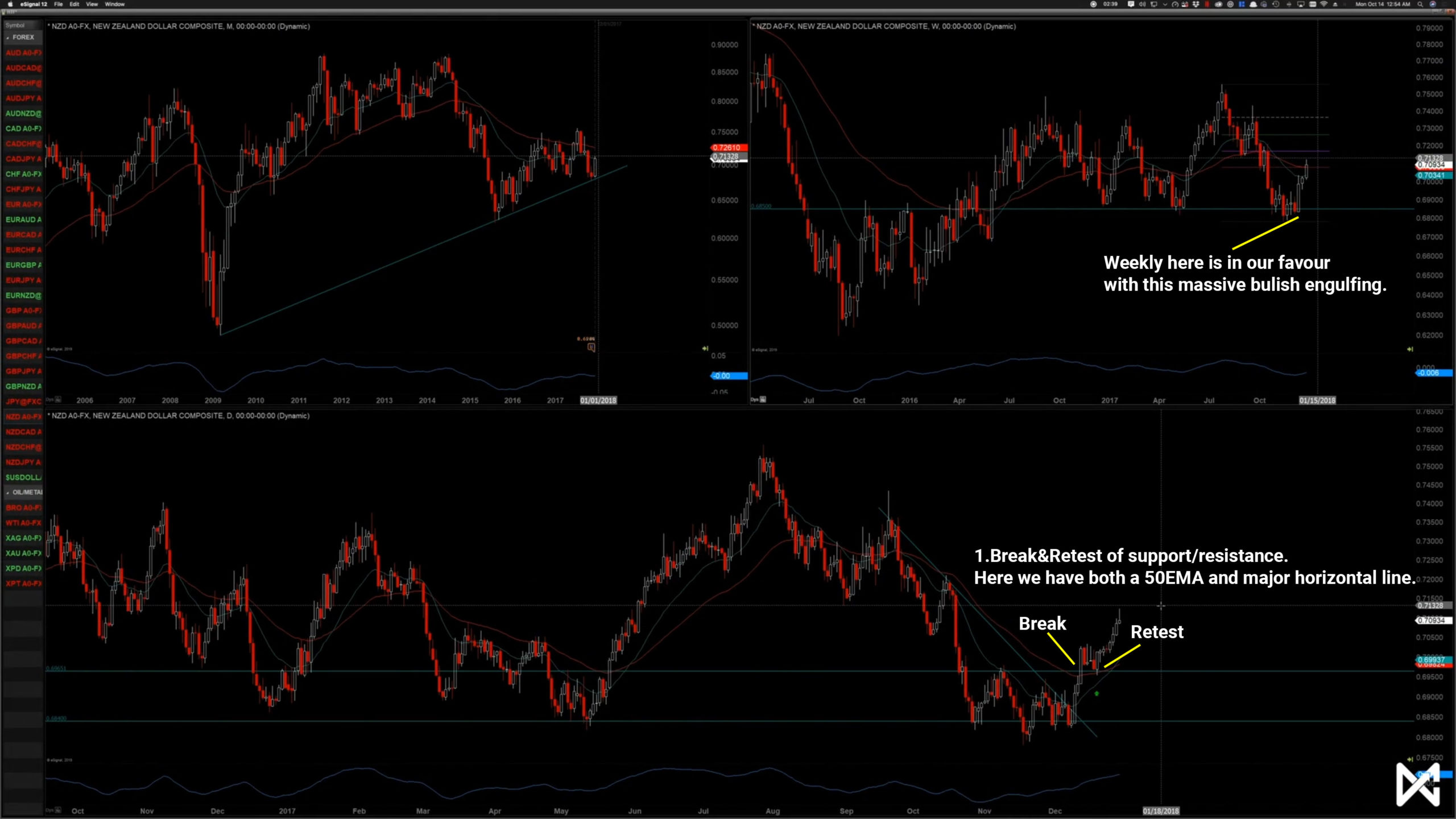

6. Multi-Timeframe Analysis

A run on a higher timeframe is a trend on a lower timeframe

A trend on a lower timeframe is a run on a higher timeframe

Deceleration On MTF

Deceleration is simple. When something is slowing down at support look for some kind of bullish price action. Patterns, Candle Sticks, Full Trend Change.

When we are decelerating on a higher timeframe we should have a little bit more (confirmation) on a lower timeframe.

Higher Timeframe:

Lower Timeframe:

Consolidation On MTF

Why is price consolidating? Why are we not breaking out or down, why just sideways? Simply looking at 1 timeframe, is not going to tell us. That's why we look at other timeframes as well.

The only way to know when consolidation on a higher timeframe ends is to look at a lower timeframe and look for it to break consolidation to the upside or downside.

For example. The daily is consolidating, because the 4h is within a price action pattern, once it breaks out of that, consolidation ends.

Candlestick Formations Using MTF Analysis

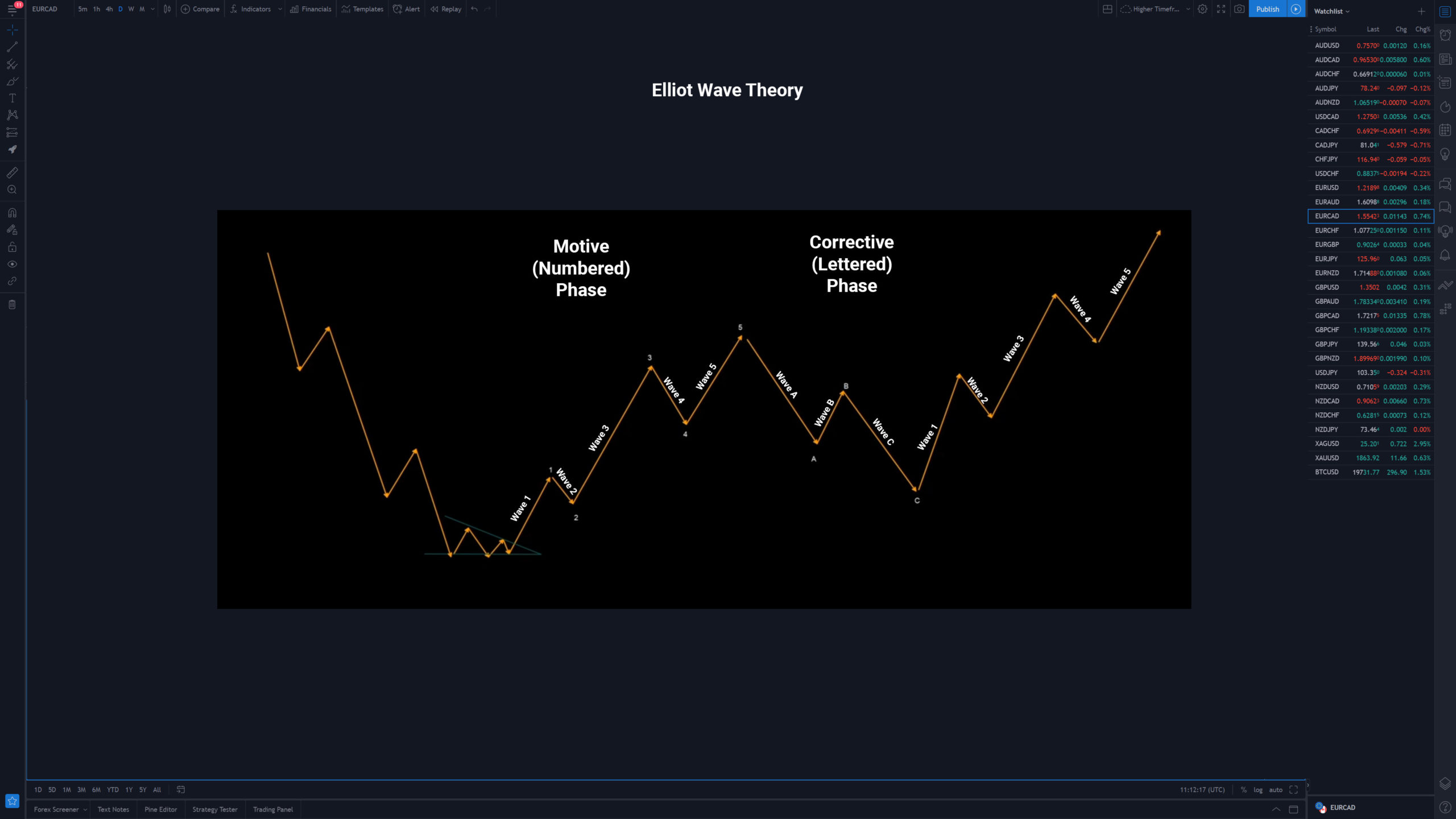

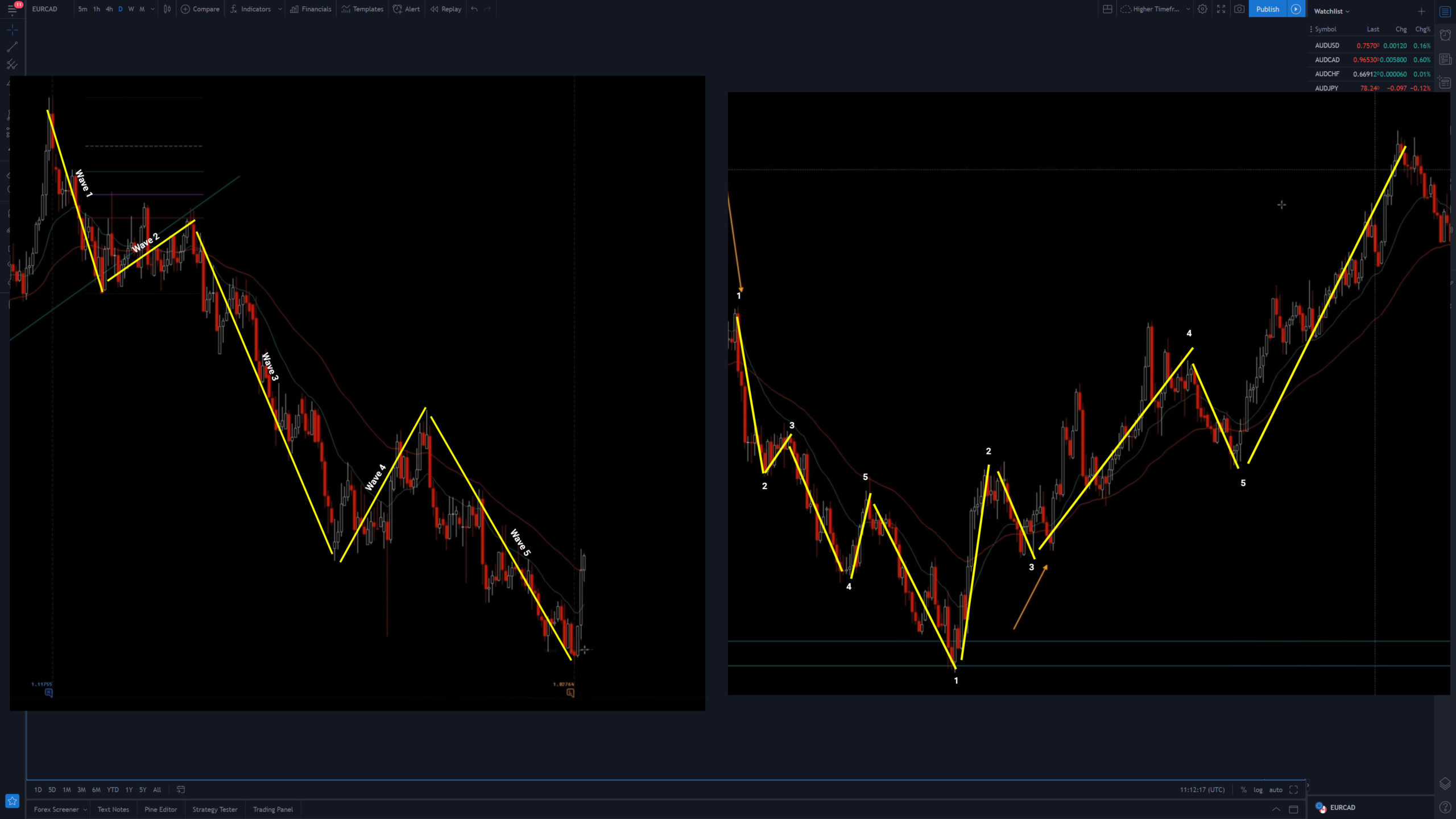

Elliott Waves & Multi-Timeframe Analysis

8.Major Trading Styles

Intro to Trading Styles

Everybody is different and therefore, there are different trading styles you can focus on depending on what you’re looking to achieve. In the next few lessons, you’ll learn about swing trading, day trading, and a hybrid style of trading, which includes mixing characteristics of both day and swing together.

Long-term Trading (Swing Trading)

In this lesson, you’ll learn what swing trading is, it’s characteristics, and who it’s suitable for. Swing trading can be considered more of a part-time trading approach.

Swing trading is good for those who love their job and want to trade part-time. It’s also great if you are travelling.

When you hold a position for over a week. Even 1-3 months. You focus on higher timeframes.

Short-term Trading (Day Trading)

In this lesson, you’ll learn what day trading is, it’s characteristics, and who it’s suitable for. Day trading can be considered more of a full-time trading approach.

Day Trading is full-time. You focus on the lower timeframes, but you still need to check the higher timeframes. You have to make your watchlist every single day!

Positions can last from 2 hours to a week.

There are more opportunitues with day trading, but that also means more opportunities for loss.

You spend 1 hour a day making your watchlist, figure out your position sizing, and make alerts.

Hybrid Style

In this lesson, you’ll learn what the MC Hybrid style of trading is and who it’s suitable for. This style of trading is the middle ground between day trading and swing trading (incorporating characteristics of both). It can be utilized as a part-time approach, but can also be used as a fulltime approach, alongside regular day trading.

Hybrid style is when you check the higher timeframe and the lower timeframe also, they all confirm for example that the chart is bullish, so you execute on the 5 minute chart and then hold the position as a swing trade.

COMMIT TO A STYLE!

Don't get sucked into the long-term bias for example if you are a day trader.

9.Risk Management - Execution

Limit order/entry order

Limit order/entry order is when price pulls to that level, it will execute a trade. With a limit order you are entering blind, because the price may keep going against your favour. To minimize the risk, we look for a lot of confluence factors before placing a limit order.

Positive is that you get in with the best entry price, with the best position sizing. You don't have to be present during the day.

Market order/Live entry

Majority of the time you want to wait for confirmations. Wait for a rejection. The 5 minute chart should give us a 50 EMA break, and that is when we place a live entry. With a live entry you wait for pretty much every confluence factor you can get, and only then you place a trade.

1% Rule

You only risk 1% on all trades, if you are consistent and get good returns you can increase it to 2%, but only if you meet these 3 criterias:

1: You have at least a 5% return each month for at least 6 months, preferably 12 months.

2: All of your trades has at least a 2:1 reward:risk ratio.

3: You have a strike rate of at least 50%. Preferably 55-60%

Capital Partitioning

Capital partitioning means that if you have a $100k account that you are trading with a 1% risk, you could take 50% of that account, put it into a savings account and increase your risk to 2%, that way you are still technically risking only 1% of your total balance.

This way you are minimizing brokerage risk. if a broker goes bankrupt or if there is a flash crash where your stop loss doesn't hit you are not risking your entire account.

Another example would be, you put 30% into forex, 30% into equities and 30% into cryptocurrency account and then you risk 3% on each account.

Correlation Risk

You usually don't want to trade two pairs if they are correlated. for example two CAD pairs. You could be looking at 4 very good long GBP pairs, you could of course take all 4 trades but that means you are risking 4% on the GBP going up. Instead you should pick the best 2 or even your top 1 so you don't risk 4% on one pair.

Or you could be looking to short CAD with one pair and go long CAD with another pair, that is also correlation risk and you need to look into it further. Is CAD actually strong or weak?

Another example if you are looking into 5 tech companies, they all look promising to short, but taking every trade would mean you are risking 5% on the tech sector. Insetead find the best 2 and risk only 1-1%.

Sizing a Trade

Tradingview has a built-in position size calculator. You need to know 3 things:

1: 1% risk. How much are you risking per trade?

2: How are we entering this trade and where?

3: How far is your stop-loss?

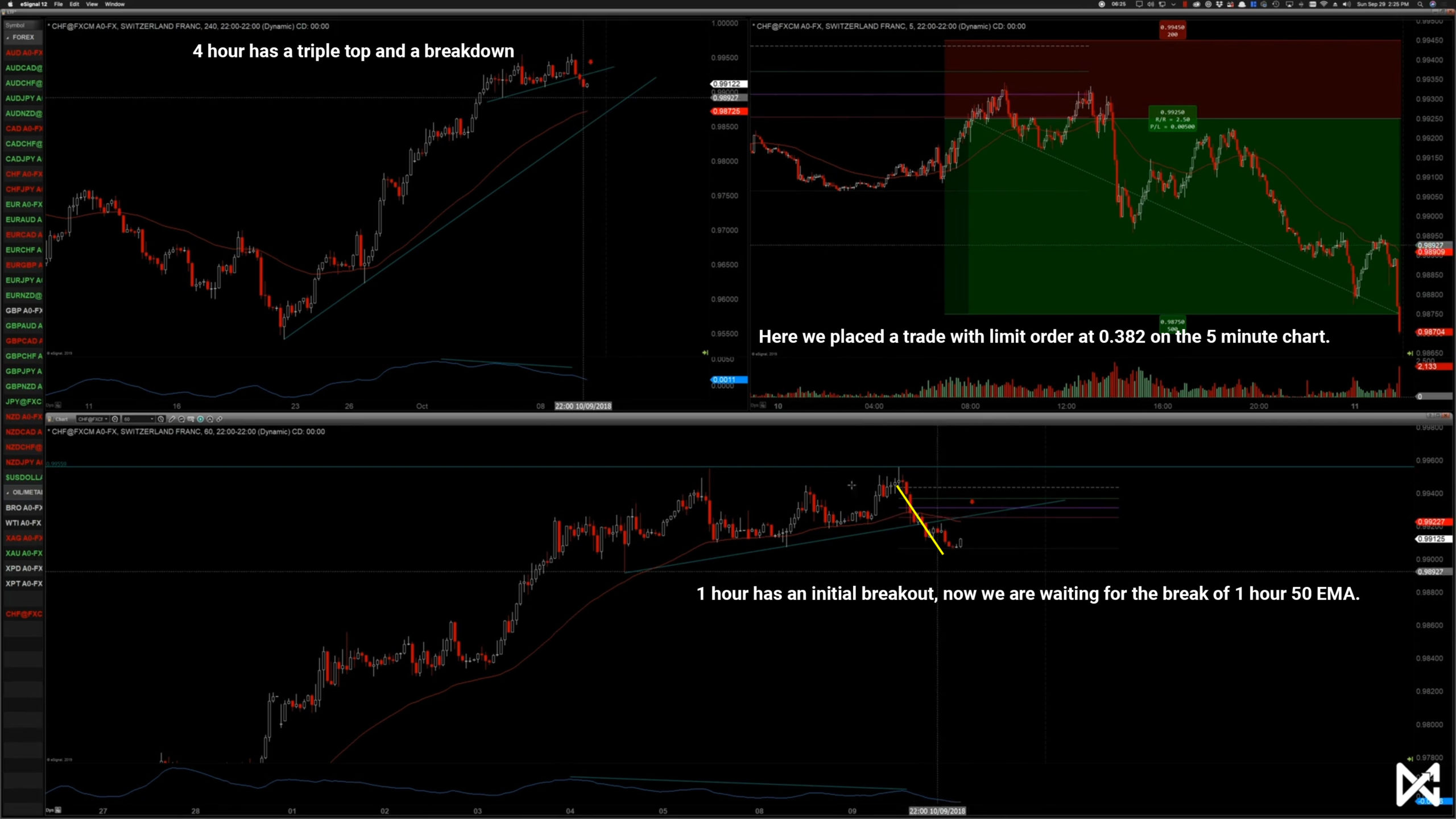

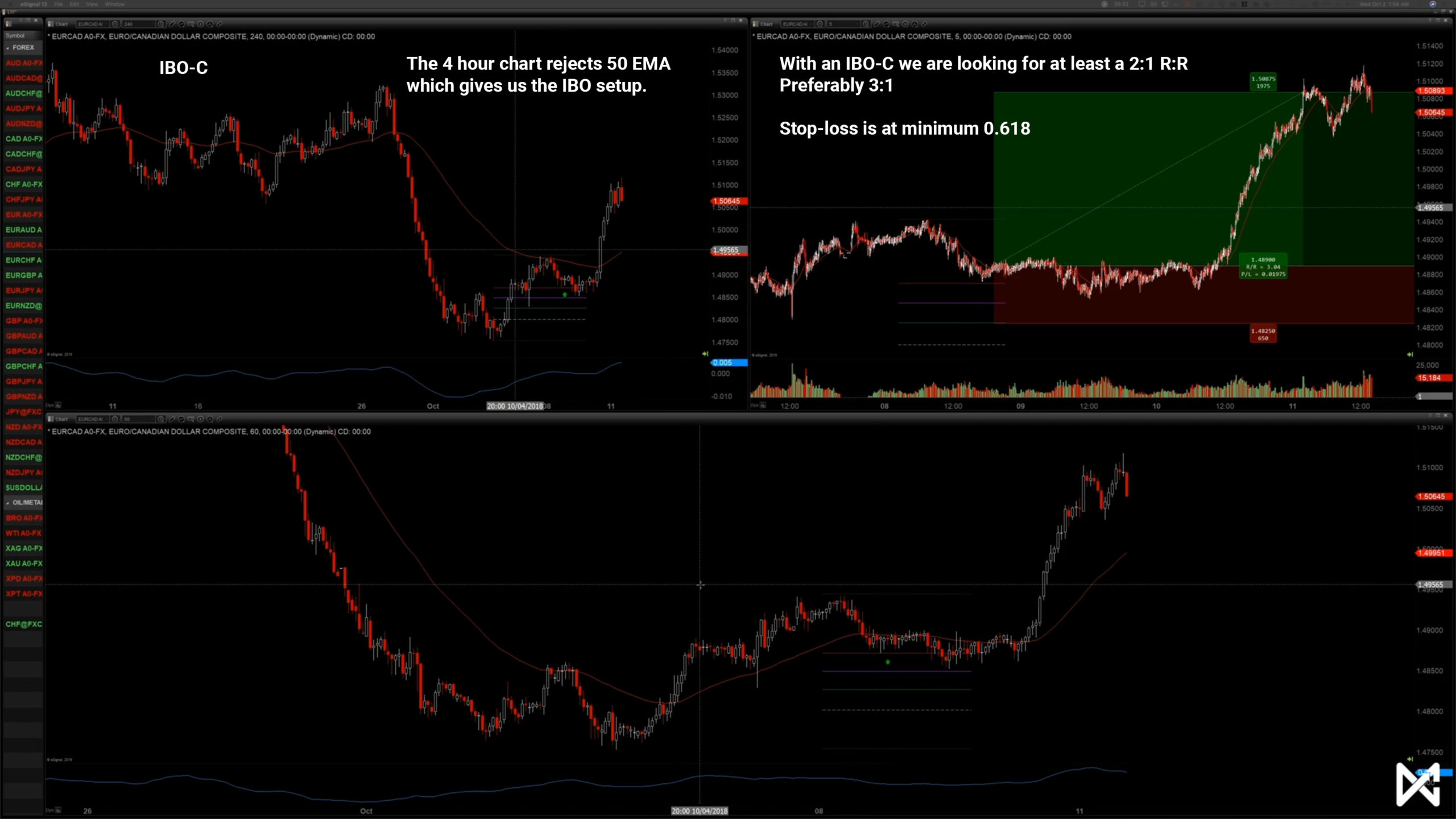

10.Strategy #1 - IBO

Initial Breakout - Explanation

IBO is simple. On a higher timeframe we have some kind of a rejection of some kind of support/resistence level. And then on a lower timeframe, we have a break and retest of the 1 hour 50 EMA. With IBO we usually try to catch wave 3 on a lower timeframe.

We start off with Multi Time Frame Analysis on higher timeframe.

For example with the daily.

Do we have support/resistance?

Do we have deceleration/candle stick formation? (reversals)

Then we look at lower timeframe.

Do we have a break and retest of the 1 hour 50 EMA?

Do we have a trend change on lower timeframe?

A run on a higher timeframe is a trend on a lower timeframe.

On the 4 hour chart you just make sure that it is not against us.

Initial Breakout - Execution

Here we don't have any higher timeframe confluence, only the daily chart is showing us a horizontal line rejection and has reversal candlestick formation.

Our stop-loss is always around 0.75 fibonacci on an IBO. Can be above or below a bit.

Safest take profit is the 4 hour 50 EMA.

You can enter either with a live entry or with a limit order.

Entering live is safer, because we are waiting for a rejection of the 5 minute 50 EMA, once it breaks, that is when we enter the trade.

Entering with a limit order however gives us a better reward:risk ratio, but it could just keep going against us hitting our stop-loss, that is why waiting for confirmation and entering live is safer.

With a limit order we enter at 0.382 fibonacci.

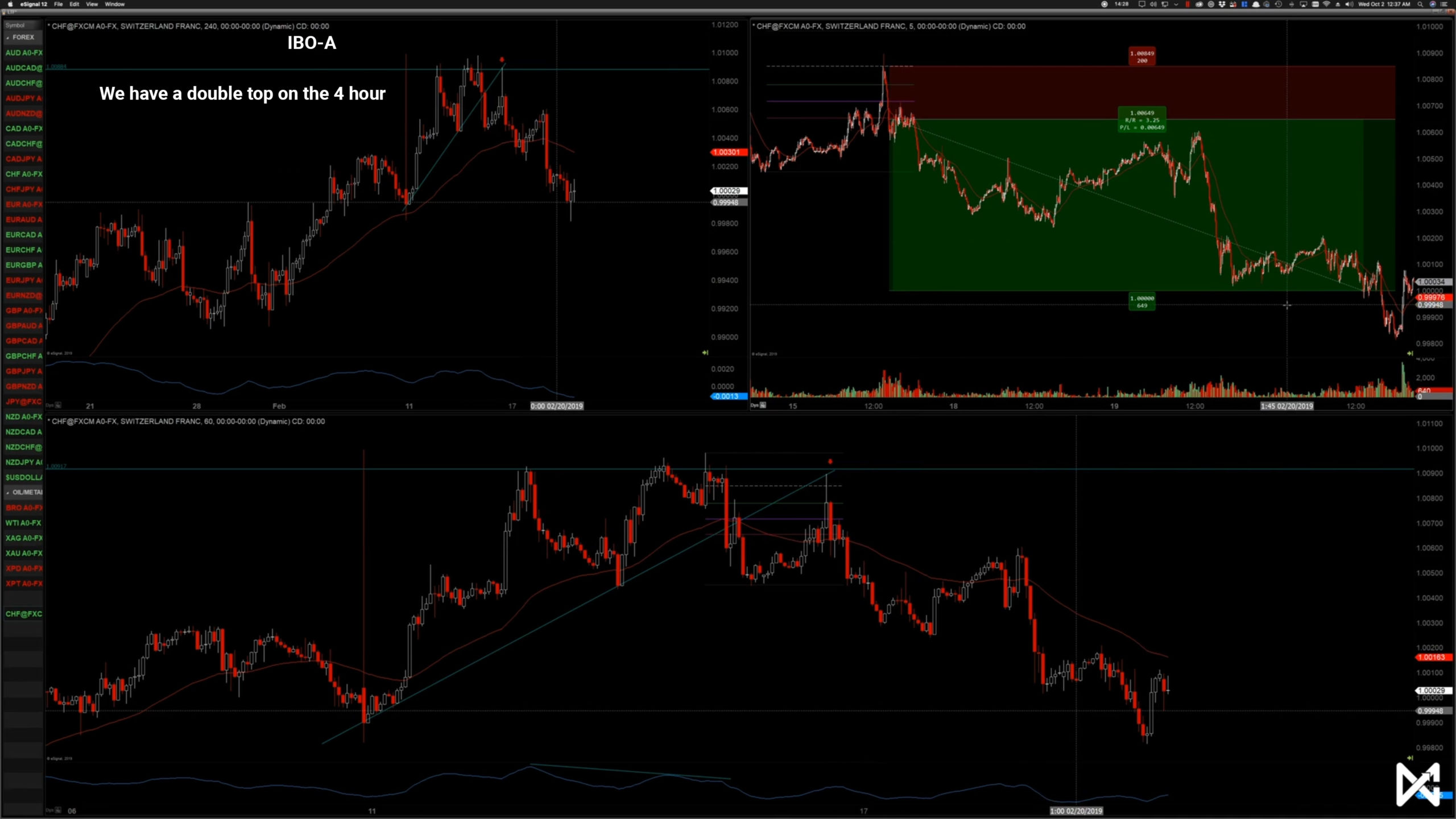

Initial Breakout - ABC Variations

From best to worst:

IBO-A: 4H already has a confirmation of a trend change.

IBO-B: 4H is developing a trend change while you are executing the trade.

IBO-C: 4H has a 50EMA rejection before the trade is being executed